The Weekly Potential #14

This week in the energy and materials industries: saving Lilium from insolvency, CATL's new EV chassis, lithium extraction in Mali, Saudi Arabian lithium from brine, zinc-ion BESS, ...

Welcome to the 14th edition of The Weekly Potential, a newsletter providing you insights into the energy and materials industries. This week we are touching upon saving Lilium from insolvency, CATL's new EV chassis, lithium extraction in Mali, Saudi Arabian lithium from brine, zinc-ion BESS, and more.

Let's dive in! 🔋

Lithium Horizons is a reader-supported publication. For deeper insights, including in-depth analysis, the latest developments, and expert insights into the energy and materials industries, subscribe below.

Industry Developments

Lilium GmbH, an electric aircraft manufacturer, has signed an asset purchase agreement with Mobile Uplift Corporation GmbH, a consortium of investors from Europe and North America. The agreement allows for the acquisition of Lilium's operational subsidiaries' assets, providing funding to restart business operations. The deal, which is set to close in early January 2025, will also involve the re-employment of staff previously let go under German insolvency laws. This transaction is part of a broader M&A process led by KPMG, aimed at restructuring Lilium's finances, and is subject to several conditions, including creditor committee approval.

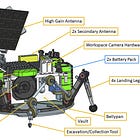

China's CATL, the world's largest electric vehicle (EV) battery maker, launched a new EV chassis on December 24, 2024, emphasizing safety as its primary selling point. The chassis, named "panshi" or "bedrock" in Chinese, is designed to withstand a 120 km/h (75 mph) frontal impact without catching fire or exploding. It features a battery with a 1,000 km range on a single charge and can reduce the vehicle production time from 36 months to 12-18 months. CATL aims to sell this platform to premium car manufacturers to speed up development and cut costs. Chinese EV brand Avatr, co-owned by CATL, Changan Auto, and Huawei, will be the first to develop models based on this chassis.

CATL’s new EV chassis. Source: Reuters Chinese lithium company Ganfeng has commenced production at the first phase of the Goulamina lithium mine in Mali. The mine, one of Africa's largest lithium reserves, was initially developed by Leo Lithium before Ganfeng acquired a 40% stake for $342.7 million in May 2024. The first phase production is expected to yield 506,000 tonnes of lithium concentrate annually, with plans to expand to 1 million tonnes in the second phase. The mine's operational life is projected to exceed 23 years, producing 15.6 million tonnes of spodumene concentrate in total. This development aligns with a new Malian mining code, increasing the government's stake to 35% from 20%, while Ganfeng will indirectly hold 65%. The project is anticipated to bring substantial annual revenue to Mali, contributing to its economic growth. However, the focus remains on ensuring responsible mining practices, environmental protection, and equitable benefit-sharing for sustainable development.

Ford, General Motors, and Toyota have each donated $1 million to Donald Trump's upcoming inauguration. Ford and GM are also contributing vehicles for the event. This move comes as the incoming administration plans policies that could impact the automotive industry, particularly regarding electric vehicles and tariffs on imports from Mexico and Canada. Ford's CEO, Jim Farley, expressed optimism about engaging with the Trump administration, while GM's CEO, Mary Barra, indicated alignment in goals, especially in strengthening the U.S. manufacturing base.

Saudi Arabia has successfully extracted lithium from brine samples from Aramco's oilfields, as announced by the Saudi vice minister of mining affairs. The project is led by Lithium Infinity (also known as Lihytech), a start-up from King Abdullah University for Science and Technology, in cooperation with Ma'aden and Aramco. They are planning to launch a commercial pilot program for direct lithium extraction soon.

Eos Energy Enterprises, Inc. and FlexGen Power Systems have signed a Joint Development Agreement to create a fully-integrated zinc-ion Battery Energy Storage System (BESS). The partnership combines Eos's Z3™ batteries with FlexGen's HybridOS™ Energy Management System, targeting a robust pipeline opportunity of over 50 GWh. This collaboration aims to enhance the shift towards clean energy with American-made technology.

South Korea emerged as the leading supplier of battery materials to the United States, securing a 33.7% share of the import market. This significant increase from an 8.5% share in 2020 was driven by growing trade disputes between the U.S. and China, which have altered global supply chains. Major Korean battery manufacturers, including LG Energy Solution, SK On, and Samsung SDI, have established large-scale battery production facilities in the U.S., contributing to this surge in imports.

Nissan, Honda, and Mitsubishi Motors have signed a memorandum of understanding (MOU) to explore a strategic partnership focused on intelligence and electrification. This agreement follows a previous MOU between Nissan and Honda, now expanded to include Mitsubishi Motors, aiming to create significant synergies in a rapidly changing automotive industry. The collaboration seeks to integrate business operations to better navigate the evolving market dynamics.

Norway has granted Morrow Batteries a loan facility of 1.5 billion crowns ($134 million) to support the scaling up and development of its battery manufacturing. This financial boost, announced by the government agency Innovation Norway, aims to enhance Norway's battery production capacity, with Morrow planning to start its first 1 GWh LFP battery factory in Q2 2025.

Paper of the Week

The U.S. Department of Energy (DOE) has released its draft Energy Storage Strategy and Roadmap (SRM) to guide future investments in energy storage technologies. The roadmap builds on previous DOE initiatives like the Energy Storage Grand Challenge, focusing on facilitating safe and timely storage deployment, empowering decision-makers with data, and leveraging U.S. leadership in the global energy storage sector.

On the Go

The sudden plunge of Northvolt into Chapter 11 bankruptcy protection was a bolt from the blue for the battery tech sector. In what felt like an instant, Northvolt transitioned from being Europe's prime contender in the global EV battery market to clinging to survival. What lessons can we draw from Northvolt's ordeal, and does this mark the end for Europe's ambitions in battery manufacturing? Ken Davis from The Battery Technology Podcast identifies the main issues that brought Northvolt to its knees.

Read More

Thank you for reading. If you found the post interesting, consider sharing it with your network and subscribing. Such actions help spread the knowledge and support Lithium Horizons.