The Weekly Potential #1

Automotive troubles, vertical integration, battery efficiency, market evolution

Hello friends,

Welcome to the first edition of The Weekly Potential. With this series, our goal is to provide you with a weekly digest covering the latest in battery technology and industry trends. Each issue will feature:

The main events in the battery industry from the past week,

A 'Paper of the Week' for those who love to delve into research,

A recommended podcast or video for on-the-go insights into the battery industry.

Whether you're deeply embedded in the industry, looking to invest, or just fascinated by battery technology, join us as we explore the dynamic developments pushing us toward a sustainable future.

Let's dive in 🔋!

You are currently reading the free edition of Lithium Horizons. For deeper insights, including in-depth analyses on industry trends, engineering advancements in batteries, and innovation, please click below to subscribe.

Industry Developments

1. Volkswagen Contemplates Plant Closures in Germany

Volkswagen (VW), an automotive giant with an 87-year legacy, is now facing unprecedented challenges, contemplating plant closures in Germany for the first time. This bearish sentiment within the company stems from a confluence of global economic pressures, including soaring material and energy costs, which have opened a shortfall of four to five billion euros in VW's financial projections. Moreover, the low profit margins on electric vehicles (EVs) are exacerbating the situation, with VW's Chief Financial Officer stating that the company has a window of one to two years to reverse its fortunes.

The tension has escalated to open conflict with the General Works Council, as VW has terminated a job security agreement established in 1994 in a bid to cut costs by approximately €10 billion, potentially leading to the layoff of up to 25,000 employees. Daniela Cavallo, Chair of the Works Council, has voiced strong opposition:

“The Board of Management is questioning nothing less than the entire VW core brand. We will not allow ourselves to be wound up here.’’

A significant factor in this downturn is the declining demand in China, where local EV manufacturers like BYD are gaining preference among consumers, leading to a 20% drop in VW's deliveries to the region in the first half of 2024.

Amidst these challenges, VW has entered into a €5 billion deal with Rivian, signaling perhaps a desperate move to stay competitive in the evolving automotive landscape. This investment aims to foster a new joint venture focused on sharing EV architecture and software, indicating VW's attempt to finally crack the code of a low cost EV.

2. Panasonic Energy Ventures into Cathode Production

In another example of vertical integration within the battery industry, Panasonic Energy has announced that it will begin producing its own cathode active material. The company plans to utilize CAMX's technology to manufacture nickel-based cathodes that require less cobalt, including types like NMC, NMCA, and LNO.

Although Panasonic has long been established as a manufacturer of battery cells, it has not, until now, produced its own active materials. This strategic shift is driven in part by the desire to reduce costs, given that cathode materials account for more than 40% of the total cell cost. Additionally, this move aligns with Panasonic's ongoing efforts to reduce its reliance on cobalt and making its supply chain more sustainable.

This development mirrors the strategies of other major players in the battery sector like Tesla and BYD, both of which are known for their high degree of vertical integration. For those interested in learning more about vertical integration in industry, there's an insightful essay on the subject by Not Boring that is well worth reading.

3. Samsung SDI Targets the Expanding BESS Market

Samsung SDI is capitalizing on the increasing demand for battery energy storage systems (BESS) in the U.S. by repurposing part of its electric vehicle battery pack production line in Michigan for BESS production. The new ESS battery pack line will be established in Factory 1, which currently houses a production line for Harley-Davidson's battery packs.

The specific capacity of the BESS to be manufactured at this facility remains undisclosed. However, Samsung SDI has recently introduced a 5 MWh Battery Box aimed at data centers. This shift might be influenced by Samsung SDI's pursuit of a $700 million deal with NextEra Energy.

Concurrently, Samsung SDI has entered into an agreement with General Motors to construct a 27 GWh plant dedicated to EV batteries,illustrating a broad approach to capturing various segments of the battery market.

Paper of the Week

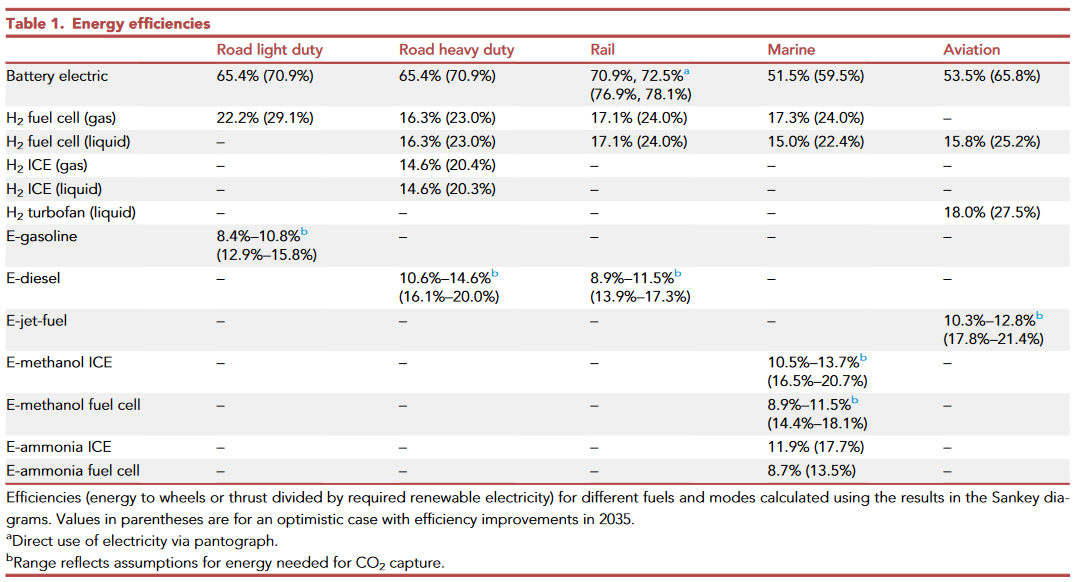

In the ongoing debate over how to power vehicles, this paper examines the efficiency of different methods. It concludes that the production, storage, and transportation of hydrogen or e-fuels result in an 80-90% loss of the initial electrical energy input. In contrast, battery-powered systems are significantly more efficient, standing out as the only solution that consistently achieves over 50% efficiency across all forms of transportation.

On the Go

In the latest episode of Redefining Energy, Gerard Reid and Laurent Segale discuss significant trends in the battery industry, highlighting an ongoing consolidation in three key areas:

Suppliers: CATL and BYD are capturing the majority of the market share, establishing themselves as dominant players.

Chemistry: Lithium iron phosphate (LFP) has become the leading battery chemistry, outpacing other types due to its safety, longevity, and low cost.

Form factor: The prismatic cell format is increasingly preferred for its efficiency in packaging, which allows for better use of space in electric vehicles and other applications.

As the battery industry evolves into a sector characterized by high volume and low margins, this consolidation makes market entry increasingly challenging for new competitors.

Read More

Thank you for reading this article. If it provided value or interest to you, please consider sharing it with your network and subscribing. It helps spread knowledge and supports this publication.

Nice summary of recent developments. I imagine that the shift toward the prismatic form factor is tied with the rising popularity of the LFP chemistry, which is more stable and has lower energy density. LFP lends itself to this form factor: https://www.lianeon.org/p/here-come-the-iron-batteries

I am curious to know if anyone out there is attempting to leverage dry manufacturing processes for LFP or LMFP batteries? Tesla seems to cracked the problem but bet the farm on the wrong chemistry. Is anyone else working on this?